Vice and Virtue are two proprietary measures of risk included in DazRatio.

Premise

These functions were developed with a client who spent a great deal of effort thinking about their portfolio and the impact of incremental changes to the portfolio. They have a large internal Research group with plenty of tools for measuring risk in different ways. What they did not have was the ability to measure risk in the same way that they thought about risk. Upside could come in all forms, but it was the drawdowns that hurt the most: drawdowns shook investors more than simple under-performance.

The most important criterion for a new marginal investment is to understand how much excess return (relative to the portfolio) it is expected to provide versus its probable impact on portfolio drawdowns.

As always, a simple number, or ratio, is nice but you also need to understand the underlying factors.

Vice

Vice is the measure of harm that a marginal investment could contribute to the portfolio’s drawdowns – the primary risk. It recognizes that an investment may have its own drawdowns, but that is okay so long as they are diversified away from the portfolio’s drawdowns. The worst situation is that the investment is affected by the same risk factors that cause portfolio drawdowns AND is more sensitive to those risk factors: Vice.

It is a combination of two variables:

- The probability that the investment will have losses at the same time as the portfolio. This is an effective measure of the commonality of the downside risk factors.

No of joint losses / No of portfolio losses - The average investment loss in excess of the portfolio loss. This is an effective measure of sensitivity to the common downside risk factors.

Total excess loss / No of joint losses

The combination of these two variables, in basis points, is the drawdown loss risk of the investment relative to the portfolio: Vice

The Vice Ratio is a risk-adjusted performance ratio similar to Sortino and others. In this case it is the ratio between the Vice of a marginal investment and its excess CAGR, relative to the portfolio. Clearly, a marginal investment that contributed significant excess CAGR with only moderate Vice could still be an attractive addition to the portfolio.

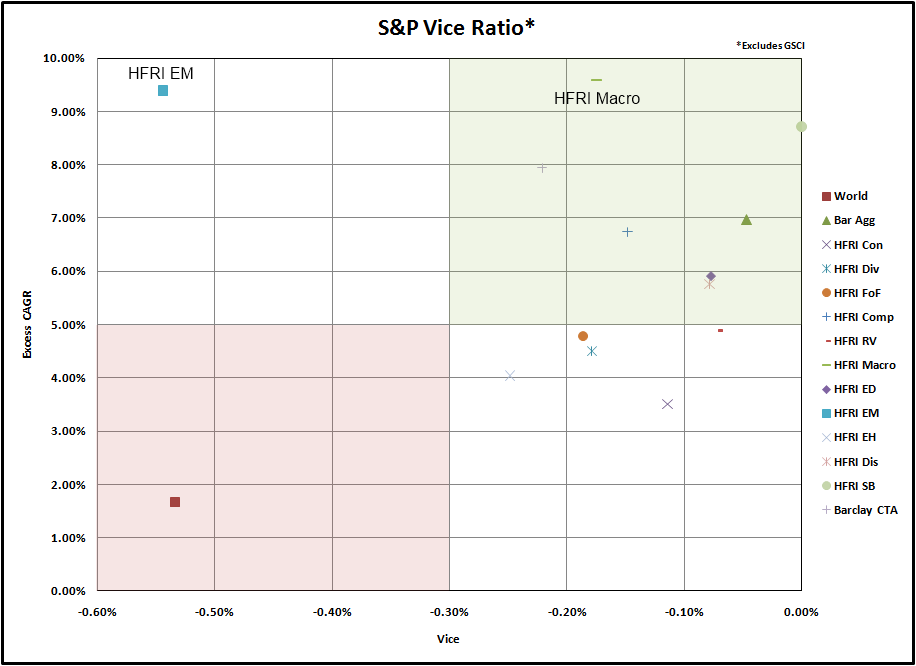

This is a plot of the Vice Ratio (Excess CAGR / Vice) for a portfolio represented by the S&P 500 with the potential addition of a range of alternative investments that might be expected to diversify the typical US equity investor’s risks. The period is five years, ending at year-end 2008. The HFRI EM emerging markets index has a high excess CAGR along with a high Vice. HFRI Macro, on the other hand, has a comparable excess CAGR with a much lower Vice. All other things being equal, you would prefer to have marginal investments from the upper-right quadrant.

Virtue

Virtue is the companion to Vice: It measures the potential diversification benefit to mitigate portfolio drawdowns. The best case is that the marginal investment has a positive excess CAGR AND produces gains in response to those risk factors that drive portfolio drawdowns: Virtue

Any combination of investment and portfolio will have both a Vice Ratio and a Virtue Ratio. Here is the same data as above, but showing Virtue:

The results are not as broadly ranging but HFRI Macro again shows up as an attractive incremental addition to a portfolio based on the S&P 500.

Why This Matters

We are drowning in statistics and ratios and comparisons. What we all need, is the measurement that balances perfectly its relevance with its intuitiveness.

Vice and Virtue are relevant to anyone constructing portfolios where the biggest risk is a drawdown that destroys investor capital, weakens your business model and forces you to redeem yourself with lower fees. If drawdowns are more critical to you than under-performance, then Vice and Virtue are relevant measures of risk.

It is my opinion that they are also intuitive:

- They are expressed as basis points.

- They are based on simple, meaningful components.

- They are easy to validate, using no transformations or statistics.

Try them in DazRatio – you might like them!