DazRisk is a site for the activities and experience of Peter N.C. Davies. More information can be found here.

These activities fall into three categories: Consulting services, Excel add-in tools and Applications.

The consulting services can be arranged on the basis of a project, a fixed term or ad hoc needs. More information can be found here.

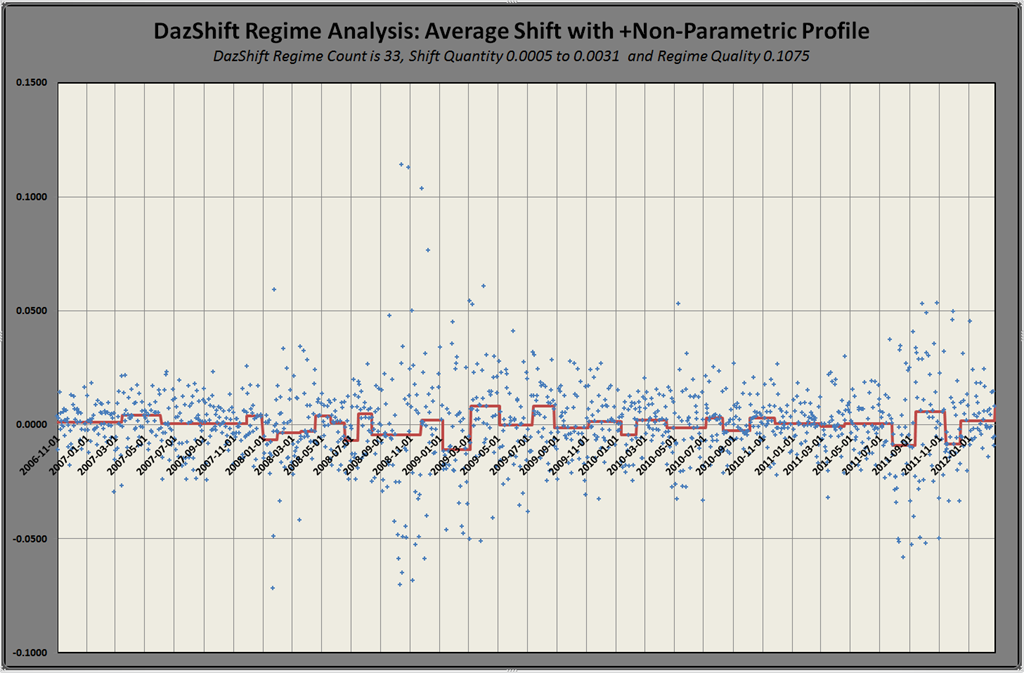

The Excel add-in tools range from Excel function libraries to analytical applications implemented in Excel. More information can be found here.

The Applications include Investment Performance Analysis that reconstructs portfolio performance with a configurable analysis based on the active investment decisions. The second application is a multi-bank data consolidation for positions, movements and performance with a highly customized and structured consolidated reporting.