by PNCD | Nov 27, 2022 | DazBeta

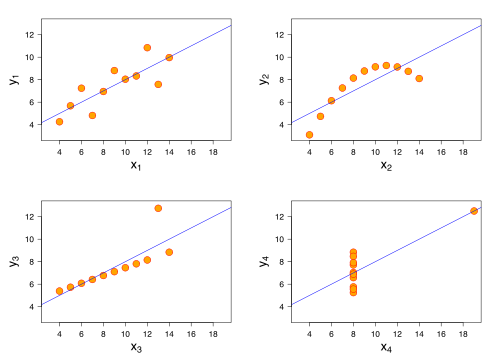

DazBeta provides analytical and functional estimates of correlation, covariance and Beta. Beta (and its associated parameters such as correlation) is one of the most common measures of ‘risk’ for investments. Indeed, it should be since diversification is one of the...

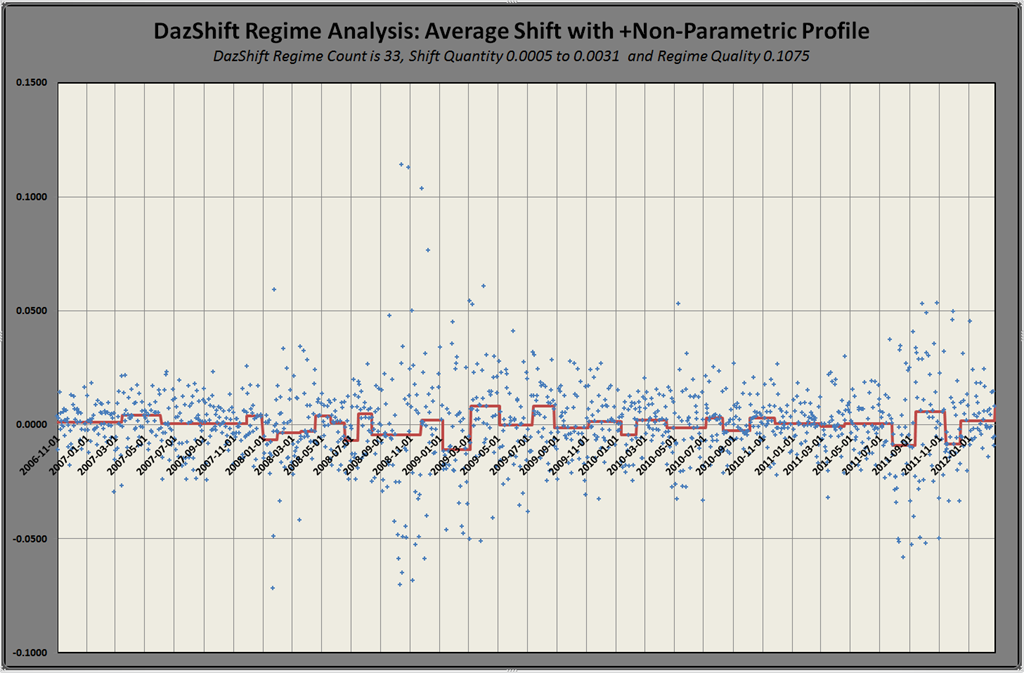

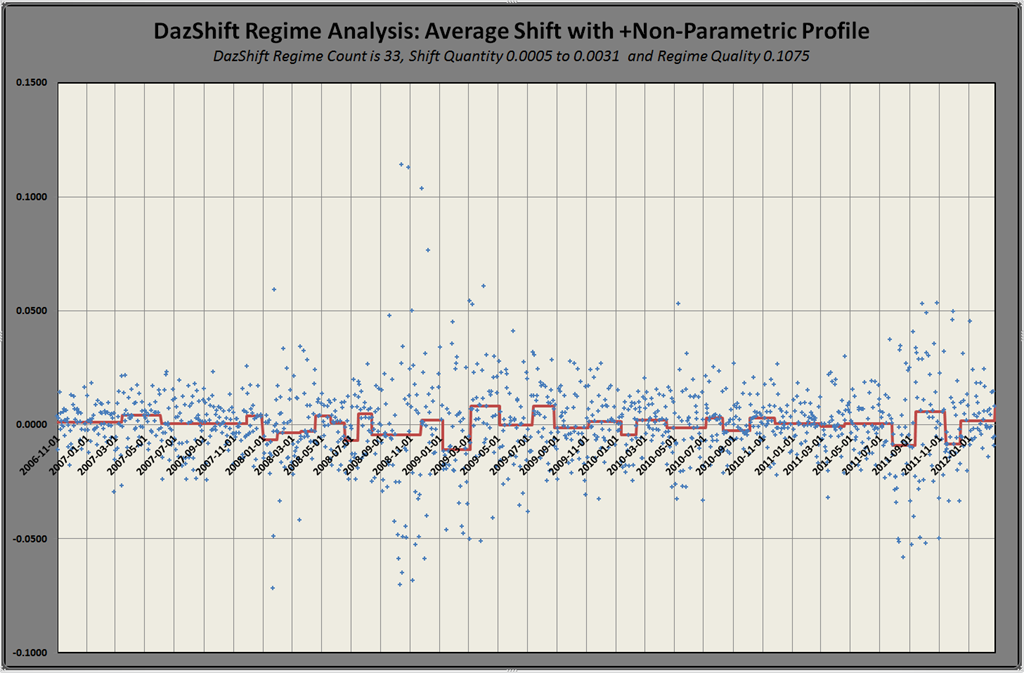

by PNCD | Mar 1, 2012 | DazShift, Featured

DazShift is a tool to analyze a data series, typically returns, for fundamental shifts in the levels of averages or dispersions. It allows a chief investment officer or an investor to monitor the stability of the investment process. Premise The premise is very...

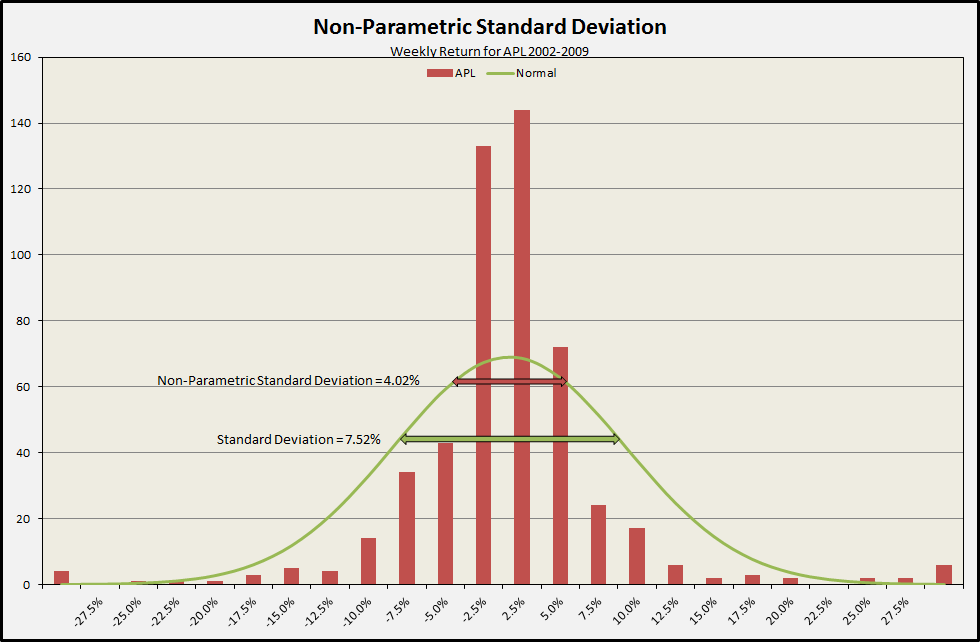

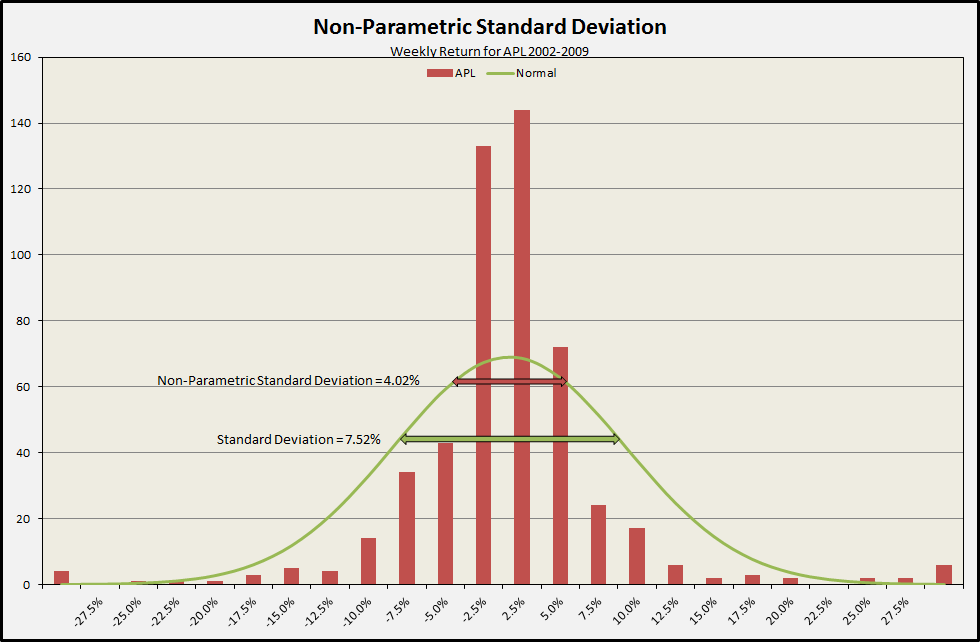

by PNCD | Jan 24, 2011 | DazStat, Featured

Non-parametric Standard Deviation and Annualized Volatility are two proprietary measures of risk that are included in DazStat. Premise The market convention uses the Standard Deviation of the returns as the primary measure of risk – annualized volatility. This is...

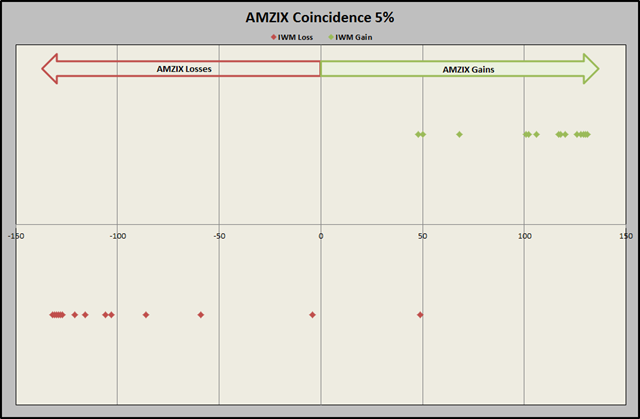

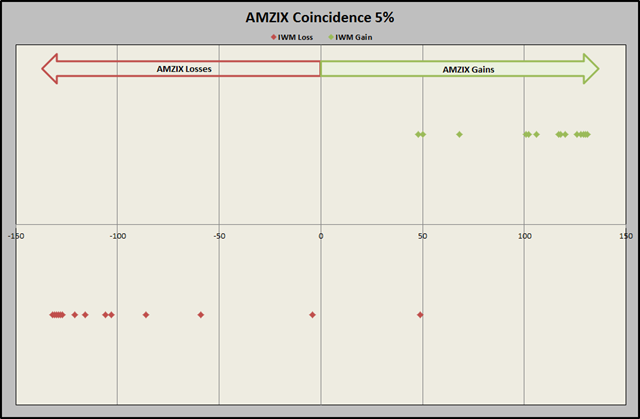

by PNCD | Jan 20, 2011 | DazBeta, Featured

Coincidence is a proprietary measure of risk that I have developed and is included in DazBeta v3.2. Premise The premise is very simple: I want to know about the expected relationship between portfolio returns and market returns I want to know about the unexpected...

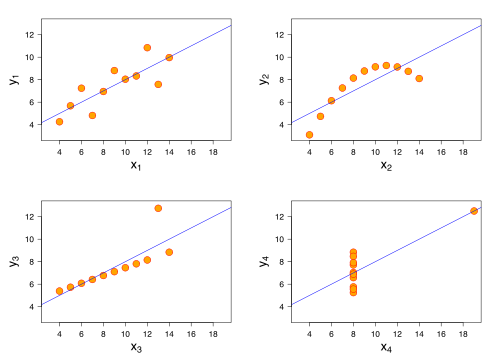

by PNCD | Dec 29, 2010 | DazBeta, Featured

Two of the proprietary measures of systematic risk that I have developed are the Partial Natural Beta and Partial Natural Correlation measures implemented in the DazBeta module. Premise The CAPM definition of Beta and Pearson’s correlation coefficient are based on the...

by PNCD | Feb 9, 2010 | DazUtility

DazUtility provides various transformations for your return data series. It does not perform any analysis on these transformations, which can be used with the other Daz modules. All transformations are placed into new worksheets in your Excel workbook without...

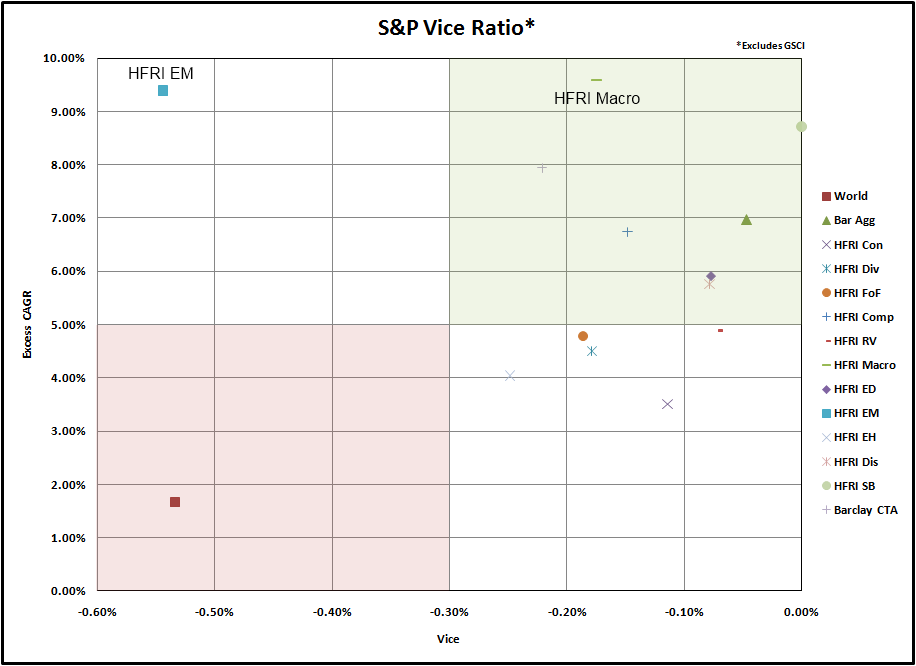

by PNCD | Feb 7, 2010 | DazRatio, Featured

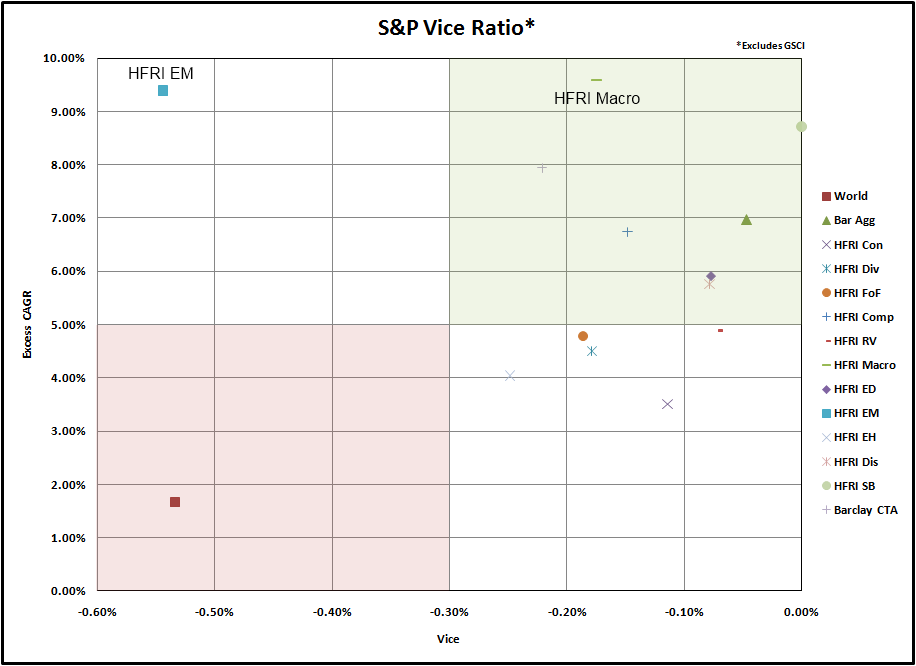

Vice and Virtue are two proprietary measures of risk included in DazRatio. Premise These functions were developed with a client who spent a great deal of effort thinking about their portfolio and the impact of incremental changes to the portfolio. They have a large...

by PNCD | Feb 6, 2010 | DazRatio

DazRatio 3.2 provides risk and performance measurement and analysis for returns. These kinds of ratios are widely used to provide summary measures for comparative analysis of investment returns DazRatio provides the broadest range of these measures to accommodate your...

by PNCD | Feb 6, 2010 | DazStat

DazStat 3.2 provides basic descriptive statistics and specific return distribution analytics. A particular emphasis is placed on whether the distribution of the returns conforms to a Normal distribution. This is a fundamental property of return distributions that is...