DazRisk is a site for the activities of Peter N.C. Davies. These activities fall into three categories: consulting services, software tools and software applications. All these activities are founded on Peter’s long experience and deep expertise as a trader, risk expert and practitioner. More information can be found here.

Consulting Services:

Peter is available to provide consulting services for financial risk analysis, performance management, investment analysis and reporting. The contract can be defined by time, deliverables or at-will.

Software Tools:

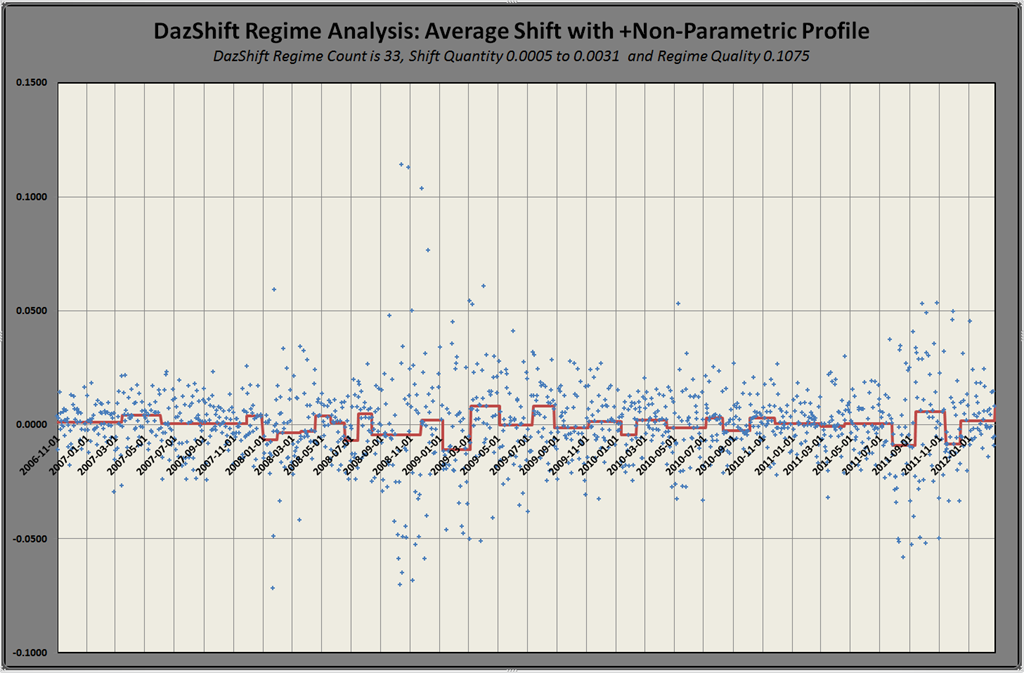

Daz Excel Toolkits are an extensive collection of different Excel tools to empower the analysis of financial risk and performance – using both in-cell Function add-ins and Excel VBA applications. All the VBA code is accessible to the user and can be extended and reused.

Software Applications:

MCR – Multi-bank Consolidation and Reporting enables investors and family offices to use their bank files to create consolidated Excel databases of positions, prices, movements and performance, together with a presentation-quality multi-bank / multi-account reporting, guaranteed by internal data integrity validation.

IPA – Investment Performance Analysis is a total restatement of portfolio performance and presentation of all factors affecting performance over time, in absolute terms and against benchmarks chosen by the client at different levels of aggregation.